The SSA’s Office of the Chief Actuary recently scored the Social Security legislation proposed by Rep. Al Lawson (D-FL). Lawson’s proposal as the second major Social Security bill in a month

In less than a month, Lawson’s proposal is the second major Social Security proposal following the Social Security 2100: A Sacred Trust proposal by Rep. John Larson (D-CT).

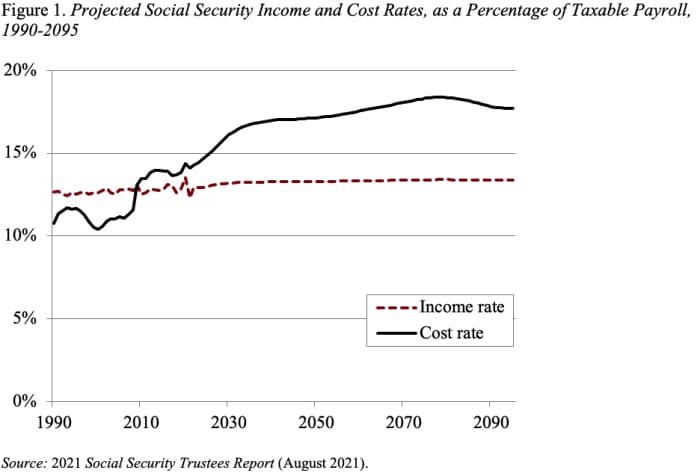

Social Security actuaries have projected a shortfall of 3.54% of taxable payrolls over the next 75 years.

The deficit is the result of rising costs and stagnant income (see Figure 1).

Read More: Senate Democrats Prompt Biden to Waive Student Loan Interest When Payments Resume

Due to the slow growth of the labor force as well as the baby boomer retirements, the ratio of retirees to workers has increased, including rising costs.

You can either raise the income rate or lower the cost rate to eliminate the Social Security deficit.

Benefit enhancements are the most significant difference between the two bills.

On one hand, the Larson bill proposes 12 enhancements over a five-year period.

On the other hand, Lawson proposes 4 enhancements that are permanent.

More specifically, the Lawson proposal states:

- Utilize the Consumer Price Index for the Elderly (CPI-E), which has historically grown rapidly than the CPI-W used to adjust Social Security benefits for inflation.

- Allow full-time students to receive student benefits until they are 23 years old.

- Raise the special minimum benefit for low-wage workers. Then index it based on average wage growth.

- Provide surviving spouses with an alternative benefit equivalent to 75% of the couple’s benefit (subject to a maximum).

Read More: New York AOC Calls on Democrats to Force Path To Citizenship Through Full Government Control

In order to fund these benefit improvements as well as to reduce the 75-year deficit, Lawson proposes to impose a payroll tax on earnings over $250,000, as well as on all earnings that reach the threshold of $250,000. Under the legislation, a 2% benefit factor would be added to average earnings exceeding the current upper limit allowed by law.

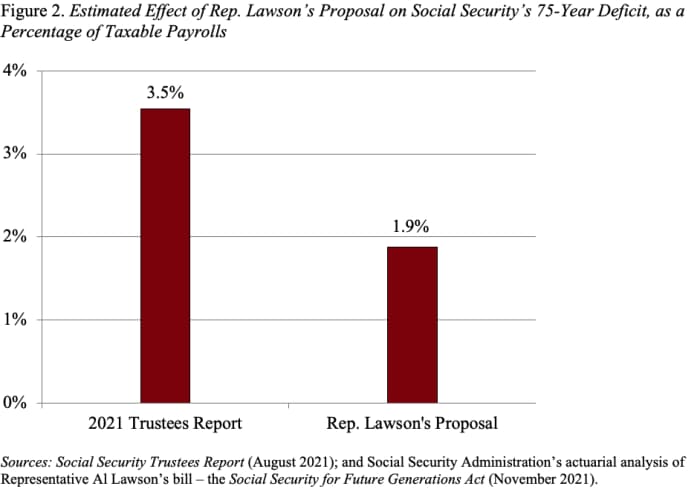

Benefits and revenue provisions included in these bills would reduce the long-term deficit of Social Security by almost half, from 3.54% of taxable payroll to 1.88% (see Figure 2).

It is worth noting that each bill has some favorable aspects.

Each bill maintains current benefits while raising new revenues.

It appears that the revenue-raising efforts of Larson’s bill will be limited because President Biden has promised not to raise taxes on households with incomes below $400,000.

As far as benefit enhancements go, switching from the CPI-W to the CPI-E for indexing benefits will cost both a lot of future revenue.

Personally, it’s best not to bother. Lawson’s other proposed changes to benefits are relatively small but positive.

Moreover, the provisions are permanent, avoiding the chaos that may have resulted from the temporary additions to the Larson bill.

At the end of the day, a solution will almost certainly involve an increase in the payroll tax rate. Under this change, people earning less than $400,000 would be taxed more.