Biden Administration Introduces New Student Loan Forgiveness Plan

On Friday, the Biden-Harris Administration shared news about a new plan to forgive student loans.

This plan was supposed to happen in July, but they’ve decided to start it in February. The goal is to help people in the Saving on a Valuable Education (SAVE) program get rid of their debts.

Here’s How It Works?

If you’ve been making payments for 10 years and started with a loan of $12,000 or less, you’ll get help.

The good part is, you don’t have to do anything – the help will automatically come to your account. Even if you owe more than $12,000, you can still get forgiveness, but it might not happen right away.

About 7 million people are in the SAVE plan, and this is the latest thing the Education Department is doing to help with loans. Before, the Supreme Court said no to President Biden’s plan to forgive $400 billion in July.

Now, they’re trying something similar with the Higher Education Act, but some experts think there might be legal challenges.

The Education Department says this new plan is especially good for people who don’t have a lot of money or went to community college.

The U.S. Secretary of Education, Miguel Cardona, says this SAVE Plan is not just the most affordable repayment plan but is designed to quickly help community college students and others with low balances get rid of their debt.

He encourages people to check out the SAVE plan to see if they can qualify for earlier debt relief.

Who Qualifies?

The new plan to forgive student loans is specifically for people in the SAVE program, which the Biden Administration calls the “most affordable repayment plan ever.”

SAVE started in August 2023, replacing the now-ended REPAYE income-driven repayment plan.

How Does Forgiveness Work?

To get forgiveness, it depends on the amount you borrowed originally, not what you still owe.

If you took out $12,000 or less for your college or postgraduate studies and have been making payments for 10 years, your entire remaining balance will be erased.

If you borrowed more than $12,000, you can still get forgiveness, but it will take an extra year of payments for every $1,000 above $12,000. So, if you borrowed $13,000, you could see relief by next year.

Why This Program Exists?

The Department of Education made this program to be thoughtful about addressing differences in situations.

Miguel Cardona, speaking to TIME, explains that they noticed people who borrowed less than $12,000 were often the ones at risk of not being able to pay back their loans.

This group includes first-generation college students and those attending community college who, for various reasons, couldn’t finish their studies. The program aims to take care of this specific group of borrowers.

Notifications and Outreach Efforts

Starting in February, borrowers will be informed about loan forgiveness.

The Biden Administration is actively working to get more people into the SAVE program. In the last two months alone, 2 million people have joined SAVE, according to Cardona.

The Education Department will begin sending emails to borrowers, letting them know about the new debt-relief plan and encouraging them to switch to a SAVE repayment plan.

Communication and Participation

Cardona emphasizes quick communication through emails. The number of people who sign up and take advantage of this program will determine how much debt forgiveness can happen.

The administration hopes to reach as many eligible borrowers as possible through this outreach campaign.

Understanding SAVE: Your Repayment Solution

The SAVE plan is one of four ways to pay back your student loans, and it’s all about making it fit your wallet.

This plan looks at how much money you make and the size of your family to decide how much you should pay every month. If you’re earning less than $15 an hour, you don’t have to pay anything each month.

According to the rules right now, if you stick with a plan like SAVE, your remaining loan balance will get wiped away after 20 to 25 years of making payments. The exact time depends on what type of loan you have.

Have a look at some of the latest trending news:

- Biden Administration Approves Urgent Weapon Sale to Israel Without Congress

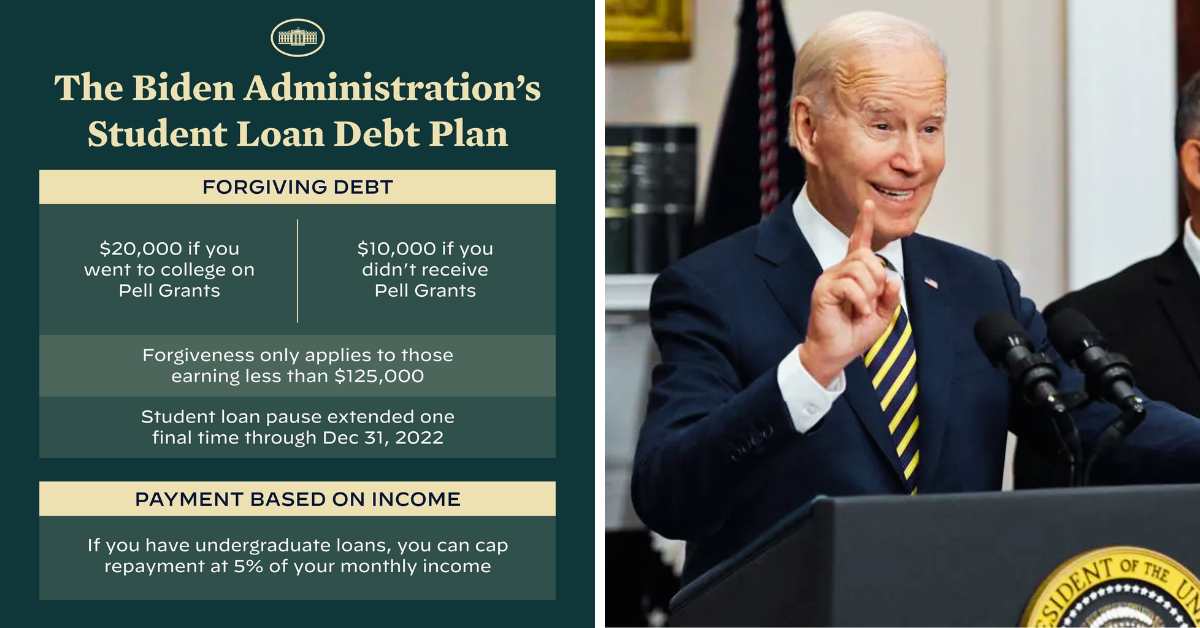

- President Biden Announces $10k Student Debt Cancellation

Exciting Changes Coming in July 2024

There’s good news for those on the SAVE plan! In July 2024, the Department of Education is planning to make things even better.

They’re saying there will be more ways to lower the amount you have to pay each month, putting more money back in your pocket.

How to Get Started with SAVE?

If you’re thinking, “Hey, this sounds good for me,” you can sign up for the SAVE plan at studentaid.gov. It’s a straightforward way to make your student loan payments work better for you.

Keep an eye out for these positive changes, and make sure to take advantage of the help that’s available.