Taxpayers Who Expect to Receive an EIC Tax Refund in 2022 Will Have to Wait a Longer Period of Time.

If you earned a low-to-moderate income in 2021, you may be eligible to claim the EIC (Earned Income Credit), which is also known as the EITC (Earned Income Tax Credit), on your 2021 tax return, if you meet the eligibility requirements.

This may or may not entitle you to a tax refund from the EIC in 2022, or as we like to say, a few extra dollars in your pocket in the meantime.

While we regret informing you that you are eligible to claim the EIC on your taxes, we must inform you that the IRS will not be issuing refunds for this credit as quickly as it will for other credits.

What is the EIC tax credit, who is eligible for it, and when will the IRS begin issuing EIC tax refunds in 2022 are all questions that need to be answered.

What is the EIC, and who is eligible to apply for it?

Taxpayers who qualify for the EIC may claim it as a refundable tax credit on their income tax returns. The amount of money you earn, your filing status, and the number of children you intend to claim on your taxes are all taken into consideration when determining your eligibility status.

They’re also used to figure out how much of a tax credit you’re eligible to receive. The following are the basic rules that the IRS uses to determine whether or not you qualify for the EIC:

- Your investment income for 2021 was less than $10,000.

- You are in possession of a valid Social Security number.

- You were a citizen or a resident alien of the United States for the entire year 2021.

- In 2021, you will not be required to file Form 2555.

In addition to meeting the requirements outlined above, you must file using one of the following filing statuses:

If you are married, you can file jointly.

- The head of the household

- Single

- If you are married, you must file separately.

- Those who qualify as a widow or widower

The EIC is only available to you if you had a qualifying child who resided with you for more than half of the year in question in 2021 and if either of the following conditions were met:

- During the last six months of the year 2021, you were living apart from your spouse.

- At the end of 2021, you were legally separated from your spouse and no longer reside with him or her.

It’s important to note that the IRS does allow those who meet the basic requirements outlined above to claim the EIC on their taxes, regardless of whether or not they have qualifying children.

A qualifying child is one who is under the age of 19 and who has received financial assistance from you for more than half of the calendar year 2021.

When will the IRS begin issuing EIC tax refunds, which is expected to begin in 2022?

The IRS claims that it typically begins issuing tax refunds within 21 days of accepting your return; however, those claiming the EIC may have to wait a little bit longer.

On the IRS website, it is stated that the agency will not begin issuing EIC tax refunds until March 1, 2022, or a few days earlier for those who have set up direct deposit with the agency.

In essence, you may have to wait until the beginning of March for the IRS to issue an entire refund to your account.

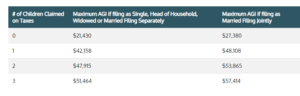

What is the maximum amount of earned income that can be claimed as EIC on tax returns in 2021?

When it comes to claiming the EIC on your taxes, the Internal Revenue Service (IRS) has strict rules. The IRS table, which stipulates the maximum amount you can earn in order to qualify for the EIC, is provided in the section below.

In 2022, how much money will I receive as compensation for the EIC?

In the event that you claim the EIC on your tax return for 2021, the following is the amount of credit you can expect to receive:

- You will pay $1,502 if you have no qualifying children

- $3,618, if you have one qualifying child

- $5,980, if you have two qualifying children

- $6,728 and if you have three or more qualifying children

The maximum amount of EIC you can receive in 2022 is $6,728 regardless of whether you have more than three qualifying children at the time of application.