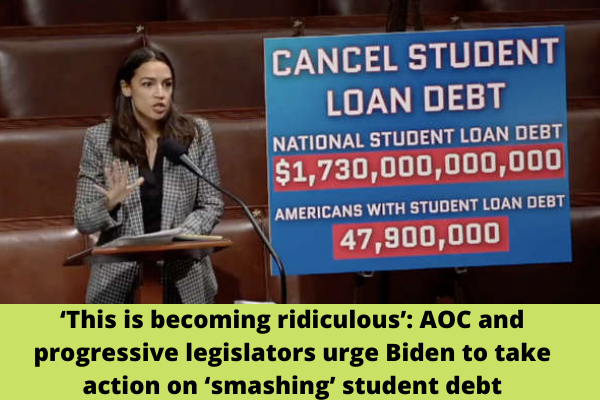

On Thursday, progressive legislators proceeded to the House of Representatives to require that President Joe Biden offset student loan checks, which has grown to more than $1.8 trillion between 45 million Americans.

Mortgages on federal student loans have been suspended, and interest rates fixed at zero percent with COVID-19 relief law in March 2020.

That stop was continued regularly but will finish in January 2022, after approximately two years of exciting economic support for millions of Americans. Throughout the public health disaster and its financial outcomes.

Most of that outstanding debt is in federally supported loans. Fans have asked Congress and the Biden legislation to drop all national debt unilaterally. Reformist legislators are preparing a last-ditch attempt to prevent loan payments as the epidemic registers its third year.

“This is continuing to be absurd,” stated U.S. Representative Alexandria Ocasio-Cortez, one of the parts of Congress who is yet giving off the university’s outstanding mortgage.

Her mortgage profit is $17,000, she stated. She didn’t work to graduate school because “taking different degrees would sink me in debt I could never pass,” she stated.

The 32-year-old congress guy is the chief in her family to measure from her mother’s side.

“Rising, I was known as a kid, ‘Your future is to continue to university. That’s what’s working to encourage our family up. That’s our prospect,” she stated. “We yet do today,” she continued.

“They’re teens engaging up for usually hundreds of thousands of dollars in the mortgage, and we do that. And our administration admits that. We’re providing 17-year-olds the capacity to sign up for dollars in liability, and we believe that’s a stable policy.”

Student mortgage has skyrocketed across the prior decade as registration at private colleges grew and national, and state legislatures severed higher training funding upon rising wealth disparities.

Excellent student deficit is anticipated to approach $2 trillion in four years. It does not refer to funds obtained by the parents of students.

In current decades, national and state legislatures have divested funding for higher knowledge; In opposition, teaching prices have increased, national policy developments have completely dropped limits on loans, and voracious loan plans and sky-high credit rates have caught a period of borrowers in a record of debt.

That compound interest is a developing difficulty; with interest rates fixed at zero percent throughout the current dispute, borrowers have had a short break from the beginning to pay off their principal. That will get to an end the following year.

In his remarks on Thursday midnight, U.S. Representative Jamaal Bowman stated student claim before the epidemic was political pressure and “also more significant now.”

“For years, people have been making everything they can to get monthly payments, but can barely manage to keep up with the matter that collects,” Representative Bowman stated, leading to the thousands of Americans who have “spent hundreds of dollars every month for years.” without examining the entire amount they owed drop.”

A new review of larger than 33,000 borrowers of the Student Debt Crisis Center discovered that 89 percent of respondents in February are not financially certain regarding continuing payments.

One in five respondents stated they would nevermore be financially stable just to begin paying again.

Respondents stated their student accommodations “suck up a huge part of their assets and stop them from giving other charges, such as rent, car loans, and pills,” the report stated.

“These decisions are increasingly worrisome in the meaning of the country’s growing boom and price of living.”

The power of all that money can have severe long-term outcomes for defaulting borrowers, from imperfect assets to the danger of having their trained permits or driver’s grants rejected, based on the state and mortgage class.

“We are a nation that profits from impossible and crushing student debt,” stated Rep. Ocasio-Cortez. “It’s illegal. It’s illegal.”

The gap on loan repayments and credit has “provided people moving opportunity to do what they want to do,” she stated.

“And so we can finish addressing these funny articles regarding young people shooting diamond rings and not purchasing homes and destroying this production and that and not having kids,” she stated.

“That’s because we’re being overwhelmed by serious claims. No one should have run into a mortgage, pressing debt to receive instruction. It’s illegal, it’s slow, and it doesn’t serve us as a nation.”

The government has released more than $9 billion in student credits by targeted support plans for people whose schools have been cut off or within the Total and Permanent Disability Discharge Program, which supports borrowers who cannot run due to physical or psychic injuries.

Throughout his drive, Mr. Biden offered a mortgage relief program that would drop up to $10,000 in freshman or graduate scholar loans for each year of nationwide or area service, above five years.

He further created a proposal by Senator Bernie Sanders and U.S. Representative Pramila Jayapal to defer federal student loans for borrowers from government schools and colleges offering up to $125,000 a year, involving students at special historically black universities and colleges to the phylogenetic resources way.

Those plans were not involved in its central national authoritative packages.

The U.S. Department of Education recognizes whether the administrator can drop student loan debt by administrative work.

Reformist lawmakers have further introduced a declaration requesting the president to “use administrative steps to drop most of the national student mortgage debt” and included the Student Loan Forgiveness for Frontline Health Workers Act and the Student Debt Emergency Relief Act.