In general, the sooner you file your taxes, the sooner you’ll receive your return in the mail or through your bank account (and it reduces the chances of tax fraud).

There are several factors that influence the amount of unemployment compensation you receive, including how much of your income isn’t subject to tax withholding, how many deductions and credits you claim, as well as how your W-4,

which is the form that your employer uses to determine how much money should be withheld from your paycheck for income taxes, was completed and submitted to the Social Security Administration.

It’s important to file your tax return by April 18, 2022, deadline, even if you’re a procrastinator in other areas of your life. Furthermore, if you believe you will receive a refund, you will want to know what to expect and how to protect your investment.

What is the average amount of a tax refund?

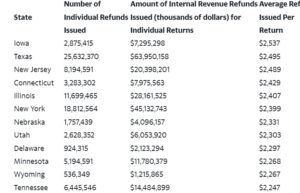

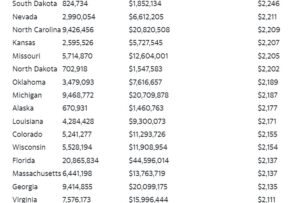

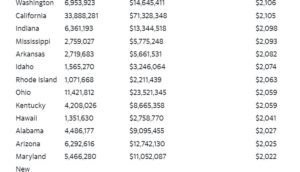

According to the IRS, the average federal tax refund for individuals was $2,184 during the 2021 filing season, which included returns submitted for the calendar year 2020.

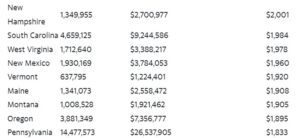

The average tax refund differs from state to state as well. According to the Pennsylvania Department of Revenue, the average refund was little more than $1,833, whereas, in Iowa, the average refund was $2,537.

To avoid becoming envious of individuals who live in Iowa, keep in mind that receiving a tax refund just means that you made an interest-free loan to Uncle Sam, and the government is now repaying you for the additional amounts that were deducted from your income.

Here’s a look at the average tax refund amount provided per state for the 2020 fiscal year, ranked from top to lowest in terms of average refund amount:

Read More: $3,000 Stimulus Check to Hit Your Bank This Month. Check Out Why?

In previous years, the Internal Revenue Service would send the majority of tax refunds within 21 days; however, the agency has taken longer to review all postal goods during the COVID-19 pandemic, and the IRS has warned that there may be delays this year as well. Certain other factors, such as the following, may cause your refund to be delayed in processing, including:

Returns that are not complete

This method returns with errors.

Returns that have been compromised by identity theft or fraud

Filings containing claims for the earned income tax credit or the supplementary child tax credit

Filing Form 8379, entitled “injured spouse allocation,” which can take up to 14 weeks to process

You can visit the IRS “Where’s My Refund” website within 24 hours of e-filing or four weeks after filing by mail to check on the IRS return schedule and the status of your refund if you filed electronically. Each day, information on the site is updated, often during the course of an overnight period.

What to Do With Your Refund If You Receive One

According to a poll conducted by GOBankingRates in 2022, 37 percent of respondents said they would use their tax refund to pay down debt. As soon as you receive your refund, it may be tempting to reward yourself and blow the money. However, paying down or paying off debts is a better option – for example, if you pay off a credit card, you can lower your credit utilization ratio and raise your credit score.

Among the other financially sound possibilities for your tax refund are the following:

Increasing the size of your emergency fund

Contributing to a retirement plan is a good idea.

Increasing the value of your property by undertaking home renovations is possible.

Contributing to charitable organizations that you can claim as a tax deduction on your next tax return

Putting the money into stocks or certificates of deposit

Putting money into a fitness or certification program is an excellent investment.

Remember that you are not required to use your refund in a “all-or-nothing” fashion; you can put the majority of it towards investments or house upgrades, for example, while still treating your family to a night out with the remainder of your refund.