In Democrats’ current proposals for financing President Joe Biden’s trillion-dollar standard security net package, legislators proposed starting a billionaire’s tax targeted at the yearly value increases of assets owned by rich individuals.

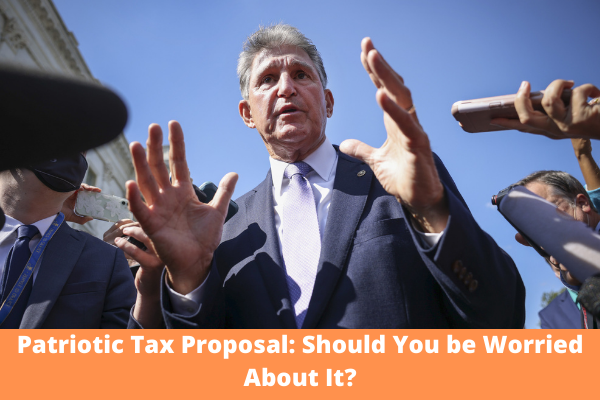

Average Democratic Senator Joe Manchin of West Virginia presently aroused attention beyond achieving the plan, stating, “I don’t want it.” Alternatively, he likes what he describes as a “patriotic tax.”

“Everybody in this nation that has been granted and benefited should pay a ‘patriotic tax,'” he said journalists on Wednesday.

“If you’re at the time to where you’re capable of handling all of the tax, tax information if you can to your benefit and finish up with a zero tax burden, but have had a very, very real life and you’ve had a lot of possibilities, there must be a 15 percent patriotic tax.”

Following this division, billionaires who avoid paying taxes by making small wages and using off their assets would see themselves giving taxes to the national government at a determined rate.

Anyone with higher than $1 billion income or more than $100 million in revenue for three straight years would view a 23.8 percent tax on their initial earnings.

In June, ProPublica announced a list of data received from the IRS that described how some of America’s richest people avoid giving taxes.

ProPublica devised a “real tax rate” that examined how much the 25 most generous Americans paid in taxes to how critical their Forbes ranked capital raised.

The research discovered that Warren Buffett gave an actual tax rate of 0.10 percent, and Jeff Bezos gave 0.98 percent. Michael Bloomberg gave a rate of 1.30 percent, while Elon Musk settled a rate of 3.27 percent.

Administrators have been slow to support tax codes, despite the wealthy’s centers of bypassing regular national tax rates.

The prevailing rates vary from 10 percent for single people earning under $9,875 a year to 37 percent for individuals earning more than $518,401 a year.

Utah Senator Mitt Romney, whose net value is assessed at $300 million, worries that following prolonged tax laws, “multibillionaires are continuing to see and respond, ‘I don’t need to spend in the stock market, because as that moves up, I gotta get charged.

So perhaps I will alternatively spend in a property or in landscapes or things that don’t create jobs and build a more powerful market.'”

Furthermore, Manchin stated he doesn’t want the “meaning that we’re targeting many people” who “offered to society” and “produced a lot of projects and spent a lot of money.”

With his devoted tax, Manchin assumes the rich will view paying taxes as their “patriotic responsibility” to help “this big country” that he stated has given them “security and the care and the opportunities.”

Please stay connected with us for more info and news!