Despite the fact that Social Security is on the verge of collapse, the organization suffered another dismal financial year in 2022.

Because of a fixed investment philosophy that hasn’t been modified since 1935, America’s primary pension plan has seen its investments lag behind the expanding markets, competition, and even inflation, for the third consecutive year.

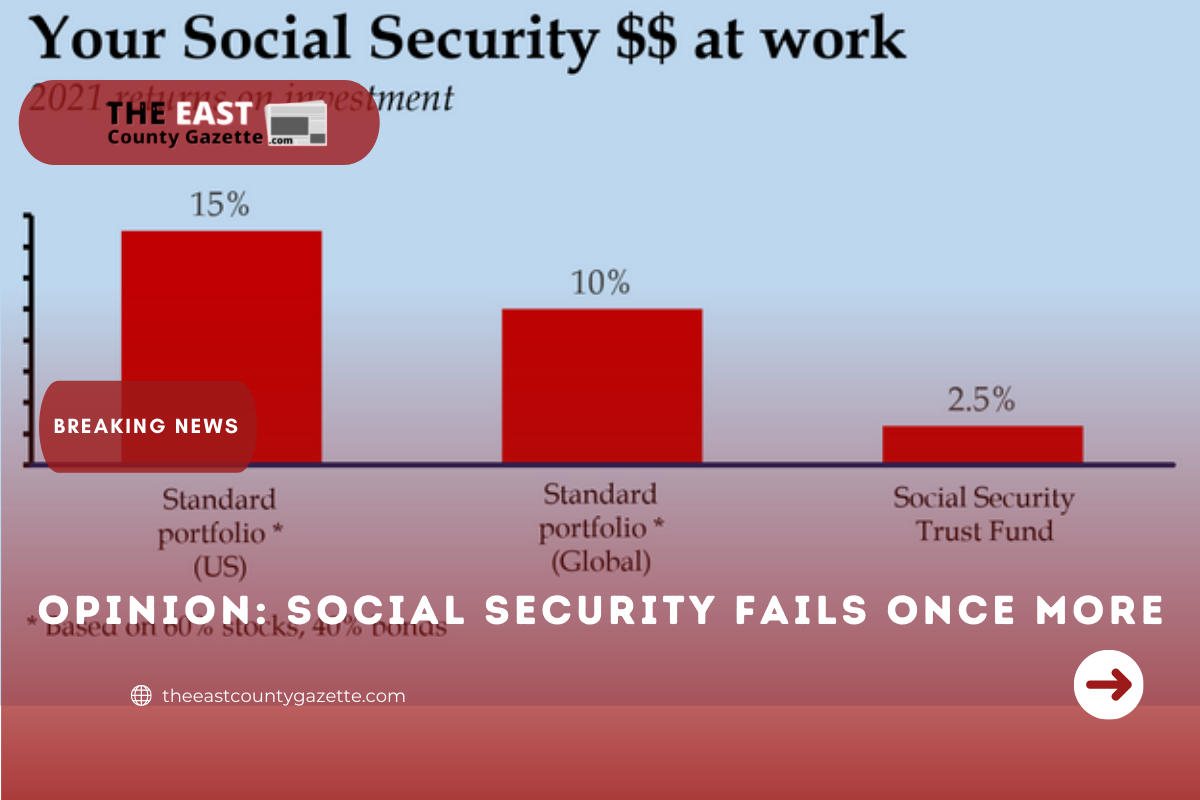

The trust fund earned only 2.5 percent on every dollar invested last year, according to the trustees, who just announced their findings. Comparatively, financial markets had a banner year, with the S&P 500 index SPX, -0.41 percent rising by 29 percent, overseas equities up 11 percent, real estate trusts up 32 percent, and commodities up 26 percent.

Despite the fact that nearly all U.S. workers are required by law to contribute 12.4 percent of their earnings to the Social Security trust fund, their money earned only a quarter of the returns of a typical global pension plan and one-sixth of the returns they would have earned in a basic Vanguard Balanced Index Fund last year. VBIAX, minus 0.39 percent

Employees lost 4 percent of their money since the fund’s returns were less than half the rate of inflation, which means that their money was worthless in actual purchasing power terms.

Social Security’s investments have underperformed basic pension fund benchmarks in four of the last five years, eight of the last ten years, eleven of the last thirteen years, and in two-thirds of all years since 1980, according to the Social Security Administration.

During the past four decades, the average underperformance has been approximately 4.5 percent per year on average.

According to the conditions of the 1935 law that established the plan, the plan is mandated to invest 100 percent of its funds in Treasury bonds issued by the United States. There is almost no other pension plan in the world that functions in this manner.

The remainder of their money is invested primarily in more profitable equities, real estate, and other assets.

Other than Social Security, the typical U.S. pension plan invests approximately 80% of its assets in stocks and alternative investments such as commodities, real estate, and hedge funds, and less than a quarter in bonds of any kind — including not only safe Treasury bonds but also things like corporate bonds, which are riskier but yield higher returns.

The Social Security Act of 1935 established the one-of-a-kind policy of only using Treasury funds. Stocks were out of favor at the time because the United States was still reeling from the aftershocks of the Great Wall Street Crash of 1929-1932, during which U.S. stocks dropped by almost 90 percent.

Another motivation for President Franklin Roosevelt to keep the money from the new program invested in U.S. government bonds was that it provided easy money to help pay for the New Deal.

However, the policy has proven to be extremely costly to the trust fund as well as the employees who rely on it. The total return on U.S. stocks has outpaced the total return on Treasury bonds by more than 6,000 percent since the mid-1930s.

Currently, the average large pension plan in the United States, other than Social Security, expects to generate an average annual return of approximately 7 percent. Last month, Social Security announced that it would invest all new FICA funds in bonds that paid a 1.5 percent interest rate.

Read More: Biden Lied? Student Loan Forgiveness Isn’t Happening Anytime Soon

During a time when the fund is bracing for a crisis and probable insolvency, Social Security’s investment results have been disastrous. The trustees announced in 2022 that the hole in the fund’s coffers had increased by $3 trillion in the preceding 12 months, marking the largest yearly increase in the fund’s history.

According to recent estimates, Social Security is now underfunded to the tune of $20 trillion, or roughly 100 percent of the country’s gross domestic product. If nothing is done, benefits will have to be cut by around a fifth across the board starting in a decade’s time unless serious measures are implemented.

Tax increases and benefit reductions are expected to be part of such extreme measures. After a similar occurrence occurred in the 1980s, the government responded by slapping the first round of benefits taxes on Social Security claimants.

If the trust fund had been invested in a normal mixture of stocks and bonds throughout its existence, as every other pension plan has done, there would have been no financing crisis to deal with today. Social Security benefits are currently received by around 65 million people in the United States. The majority are retired employees, though there are also widows, orphans, and people with disabilities among them. Another 175 million people in the United States currently contribute to the system.

Despite the impending crisis in Social Security, many of its core principles are currently the topic of minimal political debate, according to the Social Security Administration.

For example, despite the fact that its investment strategy, which was implemented in 1935, has shown to be disastrous and that no other comparable pension plan employs a strategy of this nature, there is little or no political pressure to reform it.

In addition, there appears to be little support for ending the system in which Social Security is funded by a flat, albeit regressive, 12.4 percent income tax—even among those who ordinarily oppose all flat taxes. (The tax rate is capped at approximately $143,000 for incomes over that amount.)

As a result, someone earning minimum wage must send over $1 out of every $8 that they earn to an investing business that is mandated by law to lose money to the government. And no one says a word, not even those who constantly express their dissatisfaction with the difficulty of maintaining one’s physical and mental well-being on the minimum salary.

If Social Security becomes insolvent, it is reasonable to suppose that both liberals and conservatives in politics will attempt to use the issue to their advantage. As someone once said, you never want to let a problem pass you by without doing anything about it.

Meanwhile, when the crisis hits, only a small number of those in the political establishment will be personally impacted.

A future Social Security cut, even of 20 percent or more, will have little impact on those who are connected to the Beltway economy because of their wealth, federal salaries, outside incomes, and unrivaled connections, which means a future Social Security cut, even of 20 percent or more, will have little impact.