WASHINGTON, D.C. – The IRS is halfway through distributing Child Tax Credit Payments this year.

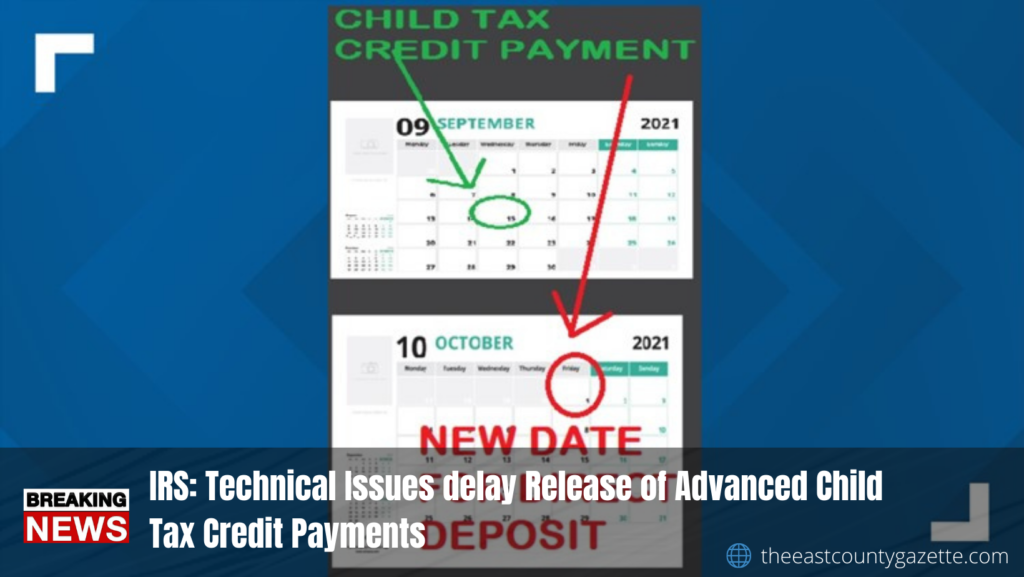

The third batch of payments went out last September 15.

However, before the fourth batch arrives, the IRS revealed that if you get a direct deposit the money could be there by Friday, October 1.

The bad news is, if you are getting a check, it could be several more days after that. The IRS explained what happened in a statement:

“There was a technical issue and estimated fewer than 2% of payment recipients didn’t get their money. The impacted group was primarily taxpayers who recently made updates on their bank account or address in the portal. We know people depend on receiving these payments on time and we apologize for the delay.”

The IRS says people are also seeing different amounts than they expected:

*If one spouse changed an address or bank account, the other spouse’s half could be going to the old address. This could lead to full payment.

*Recently processed tax returns could lead to other amounts

Got questions?

You can’t get a hold of the IRS, your best bet is to create an account and check the IRS Child Payment Portal.

Recommended Read: IRS Demands Payback of $600, $1,200 & $1,400 Stimulus Checks Benefits

The next Advanced Child Tax payment is due to go out on October 15th. The total child tax credit for 2021 is $3,600 for each child under 6 and $3,000 for each child 6 to 17 years old.

If you wish to stop getting the Child Tax Credit Payments, the next opt-out deadline is October 4.

According to a report the IRS said, “To stop advance payments or if you are making changes to your bank information with the Child Tax Credit Update Portal, you must unenroll or make changes 3 days before the first Thursday of next month by 11:59 p.m. Eastern Time. You do not need to do this each month.”