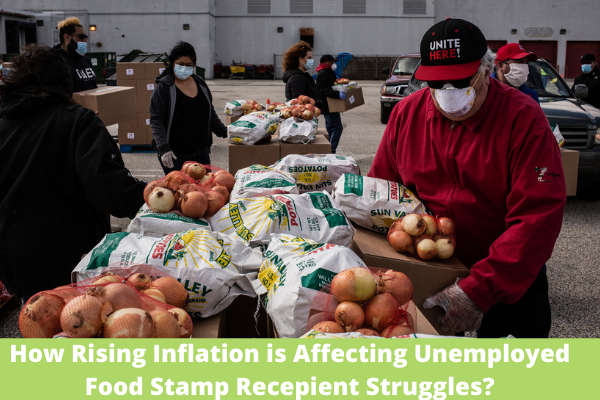

Customers who are members of the Supplemental Nutrition Assistance Program feel resumed pressure to increase their dollars due to increasing food costs and contracting bank accounts.

As the epidemic fed stimulus ends, customer packaged assets businesses will spend approximately $3 billion in purchases from SNAP shoppers per month, according to an analysis shared by IRI on Tuesday.

IRI’s Sally Lyons Wyatt stated that grocery and food companies should give perceptive budget shoppers fewer packs and affordable snack bags.

Clients who get general meals aides have fed double-digit growth for retailers and feeds producers over the past yr; though, at the time, they are beneath increasing strain to reach these {dollars}, by market investigation company IRI.

Some people who pass for the Supplemental Vitamin Help Program, commonly recognized as feeds brands, are jobless. Others are running minimal pay jobs or balancing part-time hours collectively with baby care.

With closed pores and truck driver lacks, transport and uncooked supplies cost rise, causing sticker collision on the market retailer.

Stimulus Checks Have Widely Been Used

As that epidemic-fueled funding expires, customer packaged things businesses will know the pain, too, by the IRI report shared on Tuesday.

The businesses will miss out on approximately $3 billion of spending from SNAP consumers every month. These customers’ spending power is failing, also as the Biden administration expanded food support ahead of this month and families got child tax credits.

Sally Lyons Wyatt, a state VP and apply head for feeds and drink at IRI, said economic headwinds, such as extension, are “working on hitting these houses bigger than anybody.”

SNAP is a trades driver for central grocers like Kroger, big-box gamers like Walmart. Approximately 16% of homes in the U.S., 42 million people in whole — engage in the SNAP plan. SNAP customers make 12% of feeds and drink sales online and in shops by IRI’s report.

Across the epidemic, the power of that team has only increased. SNAP shoppers made 19% of greenback growth for feeds and drink retailers. The 52-week period closed Sept. 5 versus the previous yr, by IRI.

That is in contradiction with non-SNAP customers who drove directly 1% of greenback growth during that very same time.

Lyons Wyatt said feeds and drink businesses and retailers should provide you with new ways to help buyers who need budget-friendly ways to support their families — or risk dropping a big part of the business.

She said they want to see small packages and cheap meals, such as lower-rated turn-on feed equipment.

She said that retailers could take quite diverse layers of identical stock, such as soups or managed beans of a value range, together with a regular and premium one.

She led to creative works by grocers to help households eat nourishing on a limited price range, such as producing nutritious ingredients with simple elements or sponsoring a community court for teens.

And they said businesses will miss sales now and in the long run if they remove this group of customers. She said SNAP buyers are normally extra faithful to retailers and types.

Plus, she said, feeding to households who get part in SNAP usually is a way to include themselves in prospective shoppers as many households have more youthful children or teenagers.

“You’ll fix yourself up for a life shopper worth statement that may not be there if you proceed to do not take a curiosity, really,” she said.

Stay tuned with us for more info!