The rising cost of living this year is likely to cause financial pain for many, especially as energy prices are expected to spike in April, as per the BBC Business report.

Gas prices aren’t the only thing pushing up prices at their fastest rate in about 30 years.

We’ve selected a few items that have experienced rapid price increases, along with the reasons for the increase.

Read More: RMD Formula Changes for the First Time in Decades for Retirees. Is It Good News?

1. Lunch on Sunday

When it comes to keeping costs down, families still eating roast dinners have to be a little more inventive.

Data from the same Kantar survey show fresh beef prices increased by 8.6% in the last year. A 10% rise in lamb prices, to around £11 a kilogram, was even more dramatic.

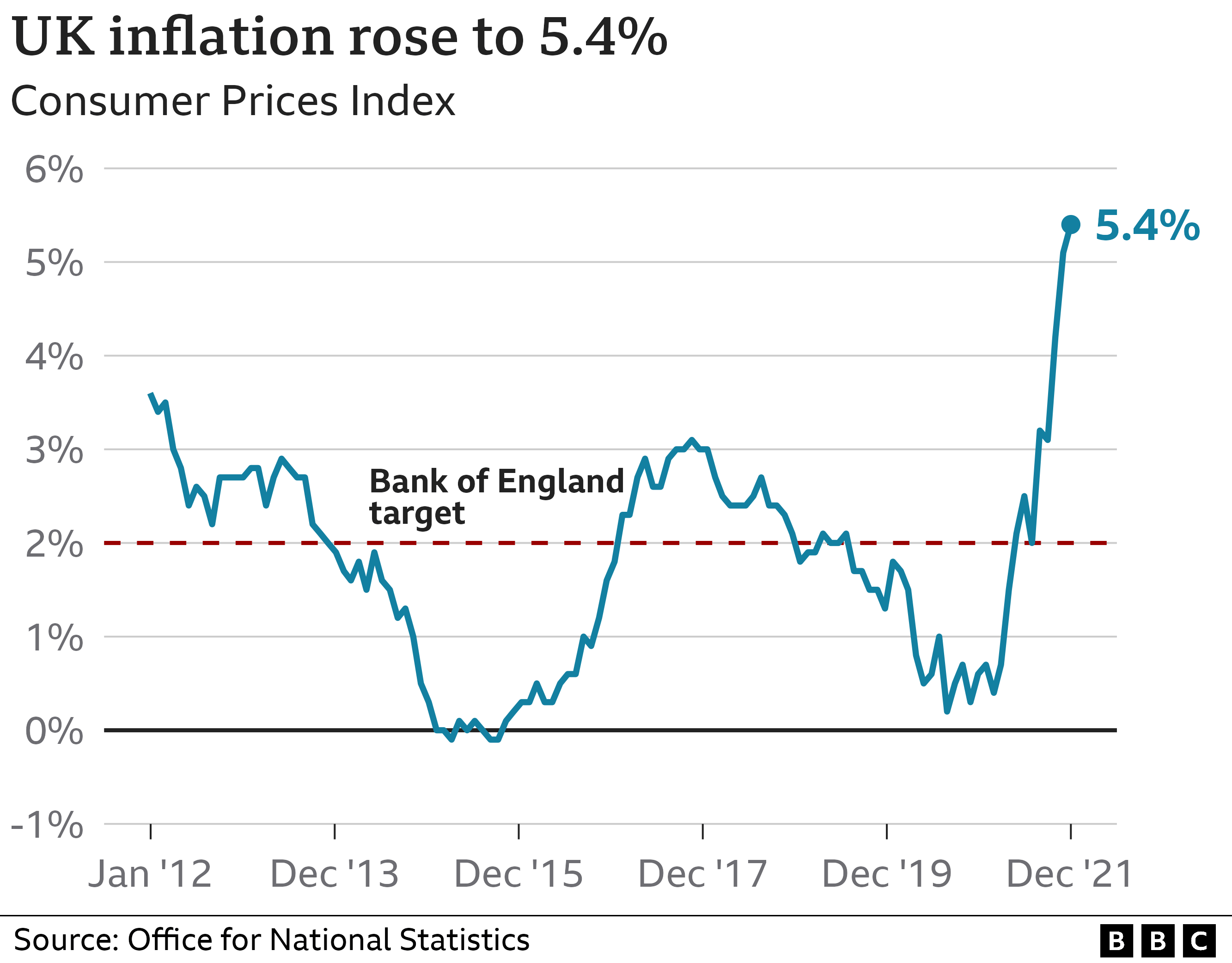

The popularity of potatoes at Sunday lunch was also cited as a factor in December’s official inflation rate via the Office for National Statistics (ONS).

Generally speaking, food prices were the primary reason for the rate rising to a level not seen in 30 years.

According to Fraser McKevitt, head of retail and consumer insight at Kantar, grocery prices have been held in check for some time, especially at Christmas, but price increases seem inevitable.

A variety of factors contribute to supermarkets’ cost pressures, including logistics, manufacturing, farming, and distribution. A shortage of drivers and increasing energy prices will exacerbate those pressures.

“Retailers will be having robust discussions with suppliers, but delayed costs have to flow through and be reflected in what consumers pay,” he stated.

Food Bank Sees Rises at an Alarming Rate

In Fraser’s view, shoppers are likely to make larger decisions when grocery prices increase above 3% or 4% annually, such as cutting back or seeking out promotions.

Meanwhile, food banks are being used at an alarming rate, Iceland’s Richard Walker said.

Fraser said the problem is that prices have gone up “in nearly every category across the supermarket shelves” and there is a narrower gap between discount brands and others than there used to be.

2. Products for the Skin

It’s possible that the moisturizers and cleansers in your bathroom cabinet have gone up in price.

In the 12 weeks to Boxing Day, skincare prices typically rose by 9.6%, according to Kantar data.

The prices of prestige brands rose despite a decline in demand, according to analysts.

As with many other cost-of-living squeeze stories at the moment, the price of skincare is shaped by the fact that there is no one-factor driving prices upward.

“The cost of shipping, packaging and raw materials are on the rise and thereby brands have little choice but to increase the price of their products to ensure that their business is sustainable,” said NPD analyst Emma Fishwick.

A few of the biggest price increases in the last quarter were reported on masks, body creams, and eye treatments.

According to her, customers’ behavior has changed as a result. Consumers are increasingly choosing mid-range brands over upmarket brands, often because mid-brands are 60% cheaper.

“Whilst consumers feel the squeeze, as the cost of living increases, consumers are increasingly turning to these brands as a cheaper alternative,” she added.

3. Furniture

The ONS noted prices in sofas and the likes, which are part of a broader category of goods, have increased steadily since the start of 2021.

Furniture, household appliances, as well as the cost to install them, have all been included.

In December, this category’s inflation rate reached 7.4%, the highest since comparable data began in 1989, according to ONS calculations.

In many ways, furniture is increasing in price for the same reason as food and skincare products. The price of raw materials – in this case, wood – and transportation has increased.

Sofas or Sette are typically viewed as luxury items, and one only buys them new after saving up the money. On the other hand, a fridge is an essential item for every family.

What is the Deal with Inflation?

The rate of price increase is called inflation. For example, if a bottle of milk costs £1 and goes up by 5p, that is 5% inflation.

From month to month, you may not notice price increases. In the present economic climate, prices are rising so rapidly that people’s hard-earned dollars do not go as far.

4. Second-Hand cars

For the first time, ONS statistics examined the effect of second-hand car prices on the overall inflation rate.

The increase in used-car prices in 2021 was 28%, compared to a 7.3% increase in 2020.

In addition to rising costs, new car manufacturers have been affected by a global shortage of computer chips and other materials like copper, aluminum, and cobalt.

Consequently, fewer new vehicles are being produced.

Thus, more buyers have turned to the used-car market, pushing prices up.

On top of that, the ONS said there are concerns within the trade that fewer secondhand cars are being offered for sale as there are not enough one-year-old cars to sell.

New car supply delays have led to longer leases and fewer part exchanges, again affecting the availability of used cars.