Americans are looking for ways to cut costs as record-high inflation pushes up the price of essentials like gasoline and groceries. One cost, however, can never be avoided: taxes

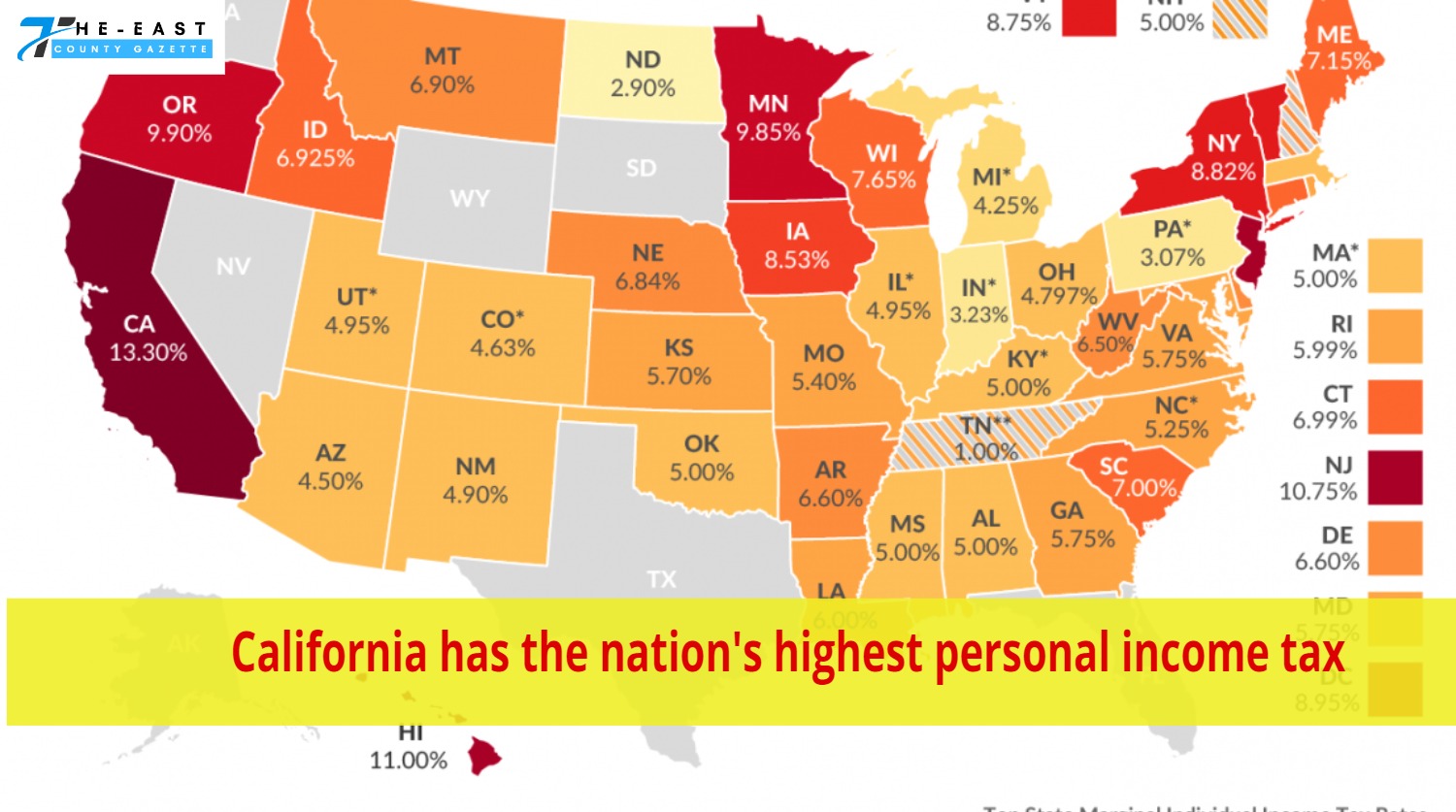

Among the states, California has the highest personal income tax, at 13.3%, according to Intuit TurboTax. However, not everyone must pay that individual tax rate.

All income in California over $1,000,000 is subject to the 13.3% rate. Otherwise, the tax rate levied by the state can be anywhere from 1% to 12.3% of your taxable income.

It’s also the highest in the country, at 12.3%.

The ten states with the highest individual tax rates are:

- California: 13.3%

- Hawaii: 11%

- New Jersey: 10.75%

- Oregon: 9.9%

- Minnesota: 9.85%

- District of Columbia: 8.95%

- New York: 8.82%

- Vermont: 8.75%

- Iowa: 8.53%

- Wisconsin: 7.65%

In total, eight states—Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington, and Wyoming—don’t tax individuals’ income but do tax other assets like property.

The 2020 U.S. Census reports that Californians earn a median annual income of $78,672.

According to the California tax calculator for 2021, a single person earning that much (without deductions) will owe the state of California a total of $4,321.

The following chart details the various tax brackets that residents of this state must pay. Some people in California are confused by the state’s high-income tax rates.

The Legislative Analyst’s Office reports that the vast majority of state revenues go toward funding K-12 public schools, municipal parks, highways, and police and fire departments.

The majority of the revenue for the state budget comes from income tax. Those in need in California may soon receive some cash assistance.

About half of qualified California residents have already received their Middle-Class Tax Refund by direct deposit or debit card.

According to the most recent data released by the state department in charge of disbursing the payments, the Franchise Tax Board, at least 6,739,880 direct deposits and 2,556,729 debit cards have been issued.

So far, roughly $5 billion has been dispersed. The state has mandated that the payments be made no later than the end of January 2023.

Source: KTLA